I want to speak briefly to the masses today. Normally our audience is the Buyer and Seller, and yet it is easy enough for anyone to become both. It could even happen that you are a Buyer, Seller, and Investor at the same time! How can this be? Me, a normal person can be a Investor? Yes. Even more than that, as soon as you start your journey you start doing something greater than yourself, building generational wealth.

I want to speak briefly to the masses today. Normally our audience is the Buyer and Seller, and yet it is easy enough for anyone to become both. It could even happen that you are a Buyer, Seller, and Investor at the same time! How can this be? Me, a normal person can be a Investor? Yes. Even more than that, as soon as you start your journey you start doing something greater than yourself, building generational wealth.

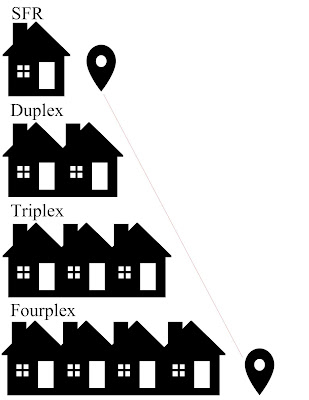

Let's start at the very beginning, a very good place to start. This beginning looks like a house purchase. That would be because it is a house purchase. Assuming you are buying this house to rent out, you are now a Landlord and Investor. The first house is going to be the scariest, it gets easier from there.

Let's assume you have rented out the house for a couple of years and you are looking to upgrade from a Single Family Residence to a Duplex. You would sell your Single Family Residence and 1031 the proceeds of the sale into the purchase of the duplex. You would go from one rent to two rents, which over time would make the property cash flow positive.

As time goes on, your life gets bigger. It is time for your investments to match your growing lifestyle. Let's sell the duplex and 1031 the proceeds into the sale of a Triplex. Two rents becomes three rents and we go back to playing the waiting game as we use our units as a tax shelter for income.

By this time, you may even have some of your family members moving into these units-or you yourselves! Since you may be planning on occupying the property, let's add another door. Sell the triplex and 1031 the funds into the purchase of the fourplex. I would also be thinking about the long term future of this property, even after you are not around. Setting your income producing property as an inheritance is a great way to provide for your family. Now, at the beginning of this blog-I am sure you were thinking that you could never own a single unit, let alone multiple units. Can you see it now? I can.

Orange, CA-TRREG DRE#01843673-RP100 DRE#02059058-P:714-831-1800-E:info@theresultsrealestategroup.com-W:www.theresultsrealestategroup.com-Facebook - Twitter - Instagram - LinkedIn

Comments

Post a Comment