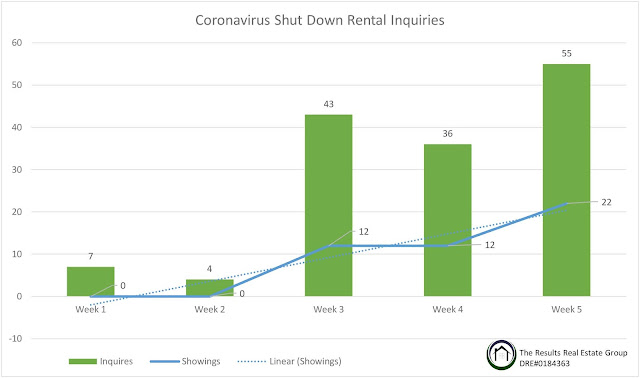

The stay at home initiative, or quarantine, began on 3/20/20. At that time we only had one active lease, we are going to call that: Rental A. We gather leads during the week and send out a showing text on Friday, for a showing - Open House Style - on Saturday (Sundays as needed). As you can guess, or lived with us, everything was sluggish as no one knew what to make of our hopefully temporary circumstances

Week 1 of Quarantine: 3/28/30

Rental A - 3 Bedroom Townhome Yorba Linda:

7 Inquiries | 0 people attended showing | 0 groups attended showing | 0 Apps

Makes sense right? Everyone was told to Stay At Home, not look for home, so they stayed home.

Week 2 of Quarantine: 4/4/20

Rental A - 3 Bedroom Townhome Yorba Linda:

4 Inquires | 0 people attended showing | 0 groups attended showing | 0 Apps

Less inquiries and similar attendance. But the show must go on right, so we kept at it. To make things even more interesting, Rental B and Rental C went live on the market between Week 2 and Week 3.

Week 3 of Quarantine: 4/11/20

Rental A - 3 Bedroom Townhome Yorba Linda:

11 Inquiries | 3 people attended showing | 2 groups attended showing | 0 Apps

Rental B - 3 Bedroom Duplex in Orange:

27 Inquiries | 10 people attended showing | 5 groups attended showing | 0 Apps

Rental C - 3 Bedroom Duplex in Orange:

5 Inquiries | 10 people attended showing | 5 groups attended showing | 0 Apps

Not a bad turn out for first showings, and even Rental A had better metrics. But if the goal of this is to have apps and someone call it home, no owner has a win to celebrate yet.

Week 4 of Quarantine: 4/18/20

Rental A - 3 Bedroom Townhome Yorba Linda:

8 Inquiries | 4 people attended showing | 2 groups attended showing | 0 Apps

8 Inquiries | 4 people attended showing | 2 groups attended showing | 0 Apps

Rental B - 3 Bedroom Duplex in Orange:

14 Inquiries | 10 people attended showing | 5 groups attended showing | 0 Apps

14 Inquiries | 10 people attended showing | 5 groups attended showing | 0 Apps

Rental C - 3 Bedroom Duplex in Orange:

14 Inquiries | 10 people attended showing | 5 groups attended showing | 0 Apps

14 Inquiries | 10 people attended showing | 5 groups attended showing | 0 Apps

Surprisingly, even though there are less inquiries summarily versus Week 3, how many people and groups showed up stayed consistent. We spoke to the owner of Rental B and Rental C and they allowed us to drop the rent on both by $100.

Week 5 of Quarantine: 4/25/20

Rental A - 3 Bedroom Townhome Yorba Linda:

16 Inquiries | 15 people attended showing | 7 groups attended showing | 2 Apps

16 Inquiries | 15 people attended showing | 7 groups attended showing | 2 Apps

Rental B - 3 Bedroom Duplex in Orange:

21 Inquiries | 20 people attended showing | 8 groups attended showing | 1 Apps

21 Inquiries | 20 people attended showing | 8 groups attended showing | 1 Apps

Rental C - 3 Bedroom Duplex in Orange:

18 Inquiries | 20 people attended showing | 8 groups attended showing | 1 Apps

18 Inquiries | 20 people attended showing | 8 groups attended showing | 1 Apps

I usually say that given the numbers, it is only a matter of time before we get an application. You can see here, even the odds of leasing started to get ansy and finally convert they way they are supposed to. Inquiries actually matched turnout mostly, and here we finally start to see the people that are "really interested in the unit". So many people like to say they are interested without putting forth the effort to attend or apply. Though there is only 1 app received so far when this blog was being written, I expect at least 2+ for Rental A and 1+ for Rental B. Rental B is similar to Rental C, so any one who did not Rental B may end up residing in Rental C. Prior to publishing this blog on Monday, app numbers were updated. Hope is alive, the market and the economy can make a come back- so says the people!

Week 6 of Quarantine: 5/2/20

This coming week, we actually have Rental D (1 Bedroom Condo in Rancho Cucamonga) coming on to the market. 2020 has been a very strong year for us and our pipeline is keeping us busy even if the results are a bit delayed in arriving. Who knows how many showings we will need to schedule for that Saturday...my hope is that it is less than 4.

Week 7 of Quarantine: 5/9/20

Two weeks from when this blog is being written is too far to project, I mention this to show you how close we are to the light at the end of the tunnel.

What is the light at the end of the tunnel? The end of quarantine of course, current initiatives state the end of stay at home is 5/15/20. You can't keep Americans at home or away from their businesses'! This has been nice for others who have taken this time to stop and smell the roses with their loved ones, but for the rest of us-we have been putting in double time to prepare for the amazingness which is America's comeback! Get ready world, America's waking up.

Orange, CA-TRREG DRE#01843673-RP100 DRE#02059058-P:714-831-1800-E:info@theresultsrealestategroup.com-W:www.theresultsrealestategroup.com-Facebook - Twitter - Instagram - LinkedIn

Comments

Post a Comment